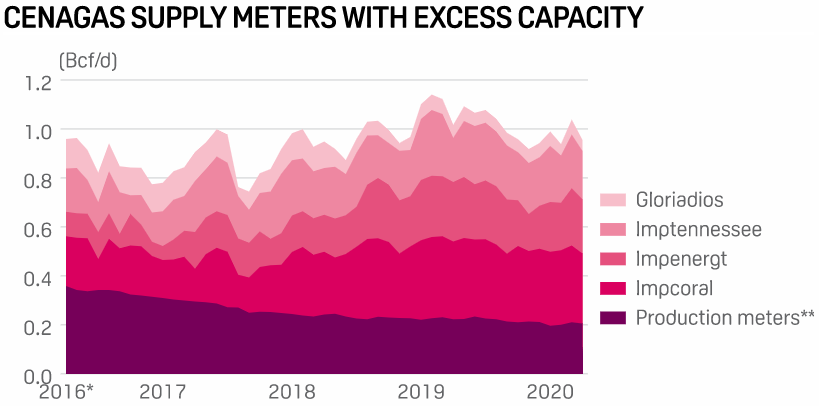

Mexican state natural gas pipeline operator Cenagas will soon make capacity available in five states in a move that, sources said, was related to the freeing of capacity by the September 2019 start of the Sur de Texas-Tuxpan marine pipeline.

Cenagas, in a posting on its website, said it had more than 380,000 GJ/d (360.2 MMcf/d) of new available gas capacity, but it did not provide an explanation behind its announcement. Mexican gas pipeline capacity has been sought by market participants for years. But the lack of transparency from Cenagas regarding the origins of this additional capacity and the decision to allocate it using the premise of “first in time, first in right,” instead of holding an open season, creates legal uncertainty that could endanger contracts, sources told S&P Global Platts.

Pipeline flow in the five states — Tamaulipas, Veracruz, Coahuila, Nuevo Leon and Chihuahua — has started to decline and at the three import points in border state of Tamaulipas there is little potential for additional gas without infrastructure improvements, according to data compiled by Platts Analytics. Almost half of the additional capacity, or 178,247 GJ/d (168 MMcf/d), has become available in the border state of Tamaulipas at three sites, Cenagas data shows.

This newly available capacity was not there during the last open season, held in 2017, when Cenagas awarded almost 100% of capacity it made available. Sources agreed the new capacity was made possible by a combination of some being relinquished by clients during the recent renovation of contracts with Cenagas and more gas being sourced from 2.6 Bcf/d Sur de Texas-Tuxpan, which brings supply from Texas.

Cenagas recently renovated the contracts with resellers and industrial clients of the 2017 open season, David Rosales, a consultant with Talanza Energy in Mexico City, told Platts. Most of these contracts, including those from state Pemex and state utility CFE, two of the biggest users, were only for terms of three years, he said.

Additional modifications on the national pipeline grid and the Gasoducto de Tamaulipas in that state could significantly increase the amount of available supply.

The case in Veracruz is different, though, Rosales said. The additional capacity there is probably a result of a decline in production in Pemex-operated gas fields in the state that formerly flowed to Central Mexico. But just because capacity is available does not mean that Pemex will be able to fulfill long-term supply obligations, a phenomenon seen at end-2018 as a lack of production caused imbalance penalties to spike to $25/MMBtu for a large industrial end-user in Veracruz.

LEGAL DANGERS, HURDLES

Any contract signed under the current conditions of opacity might be challenged legally by a competitor or a regulator if it does not meet all the legal requirements, said Daniel Salomon, an associate at law firm Gonzalez Cavillo, in Mexico City.

To avoid this, Cenagas must give a clear justification of why this capacity is now available, and why the operator considers it is better not to conduct an open season, but rather to grant this capacity under “first in time, first in right,” Salomon said.

“It´s important for Cenagas to give legal certainty to other users that the procedure for the signing of these contracts is correct and will not be subject to challenges,” he said.

Rosales said there might be a reasonable justification for skipping the open season, but he agreed that the process should be more transparent. However, he said there are other hurdles for end-users: that capacity is made available does not guarantee its availability at the injection point.

“There are particularities in each in site,” Rosales said. “There needs to be more information.”

Sheky Espejo. (2020). Mexico frees capacity in natural gas pipelines, but questions remain. USA. S&P Global. Recuperado de