Mexico will likely see growth in oil output from private companies in 2022 even as the country’s upstream liberalization remains on hold, but natural gas will likely remain underfunded, securing Mexico’s dependence on US imports.

Upstream contracts generated by the 2013 liberalization are having a small contribution to Mexico’s total crude output, but that contribution is expected to rise in the coming years.

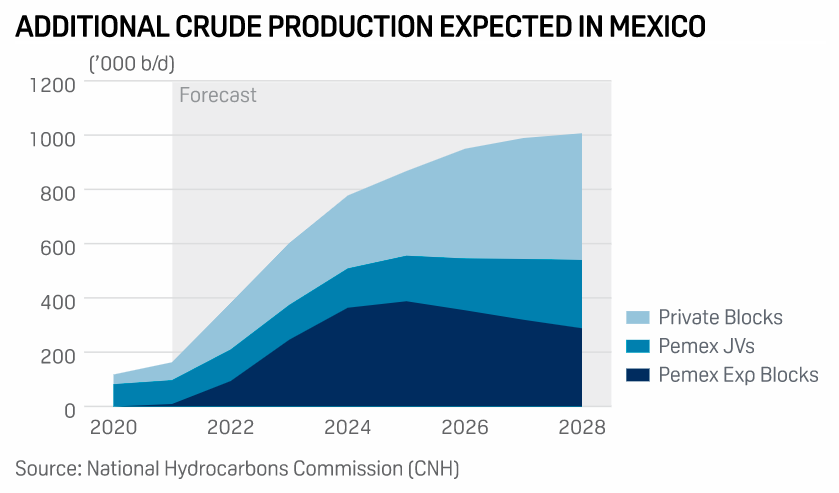

Private companies produced 68,168 b/d in October, out of a total 1.651 million b/d, according to Mexico’s hydrocarbons regulator (CNH). But private companies are expected to produce 172,000 b/d in 2022, while output from Pemex joint ventures and Pemex exploration blocks is also expected to edge higher. That would push total Mexican crude output to 1.858 million b/d, CNH data shows.

Crude output by private producers could reach roughly 467,000 b/d by 2028, which could partially compensate the expected decline in Pemex legacy production.

Since the liberalization, private companies have made 15 oil discoveries that have led to a six-fold increase in the country’s proven oil reserves, CHN data shows.

While Mexico President Andres Manuel Lopez Obrador has put the upstream liberalization process on hold, it is unlikely his administration will hamper current private upstream projects as the additional production provides a revenue stream, said Daniel Sanchez, a partner specialized in Mexico’s energy industry at law firm Baker & McKenzie.

“Without moving a finger, the government has seen money flow,” Sanchez said.

Upstream companies currently operating in Mexico have committed investments worth $42.56 billion, of which $18.6 billion have already been executed, according to a report by the national association of hydrocarbon companies, Amexhi, published Nov. 30. The Mexican state has received $ 3.26 billion in royalties so far, the report showed.

Upon taking office in December 2018, Lopez Obrador began a series of attempts to undo the energy liberalization, but as his moves have so far been halted in courts, the president has proposed modifying the constitution.

Mexico in 2022 will vote on proposed modifications giving state utility CFE control over the power sector and removing the independence of CNH. Because CNH is responsible for approving all upstream projects, some market watchers are concerned CNH will become an arm of the administration, which has prioritized strengthening state oil company Pemex.

But Pemex has also benefited from the liberalization. The company decided to “migrate” some of the blocks it operated to new type of contract allowing it to recover more of the costs and re-invest them in operations. That re-investment has allowed Pemex to increase production at those blocks, CNH data shows.

Dependency on gas imports to continue

Mexico’s natural gas sector, however, is expected to remain underfunded, meaning Mexico will continue to depend on US imports.

Mexico has imported 6.1 Bcf/d on average in 2021, above the 5.4 Bcf/d average in 2020, S&P Global Platts Analytics data shows. Mexico has produced 2.3 Bcf/d in 2021 on average, down from 2.5 Bcf/d in 2020, while demand has averaged 8.4 Bcf/d in 2021.

Pemex will not manage to increase its gas production nor will it be able to increase utilization simply because the company is not investing in the sector, said David Rosales, a Mexico-based consultant, during a virtual seminar organized recently by Mexico-based Oil & Gas Magazine.

“The company has many other projects for production of crude that are priority and gas will continue to be neglected,” Rosales said.

Gas flaring by Pemex rose to 11% of production in 2021, the highest in over 10 years, the company said in September.

Nobody in the administration is talking about a strategy to increase gas output, as they are only focused on crude, Daniela Flores, a consultant at Talanza Energy, said at the seminar.

Companies are convinced there are opportunities, given the underinvestment and growing demand.

“There is no shortage of interest in the country,” said Santiago Garcia, head of Santa Fe, the marketing unit of pipeline developer Fermaca, during a recent conference on the Mexican sector organized by S&P Global Platts. García said there is no shortage of capital either to be invested in the sector.

Mexico needs a lot of storage infrastructure and a few small interconnections to take gas to some areas of the country, such as Guadalajara, García said.

The lack of infrastructure has allowed companies like Santa Fe to find a niche providing reliable supply directly from the US, he said.

“We think Waha gas will continue to be there for a long time; it has a very good quality and remains at a very good price. It is going to be there no matter what,” he said, adding Waha has gained more popularity among users as they realize there is a price differential versus Henry Hub of around 40 cents.

However, some observers are more pessimistic and believe the halting of the upstream auctions will have irreparable consequences.

The announcement to change the constitution also sends a negative signal to the market, said Eduardo Prud´homme, a partner at Mexico-based consultancy Gadex, during the Oil & Gas Magazine seminar. Regardless of whether the proposed constitutional reform is approved or not, the damage to investors’ confidence is done because of the threat to institutions like CNH.

Even if the next administration changes heart and realizes Mexico does need private investment, in 2024 or 2030, the country will have lost a window of opportunity to give extraction a final push, Prud´homme said.

“Energy transition is coming, and even if trust were recovered, the window is closed,” he said.

Sheky Espejo. (2022). Mexico oil output to benefit from private producers in 2022, gas to stay underfunded. USA. S&P Global Platts. Recuperado de