Natural gas production in Mexico totaled 3.84 Bcf/d in May, up from 3.61 Bcf/d in May 2020, according to the latest data from upstream regulator Comisión Nacional de Hidrocarburos (CNH).

State oil company Petróleos Mexicanos (Pemex) supplied 3.63 Bcf/d of the total, up from 3.37 Bcf/d in the year-ago month and 3.53 Bcf/d in the preceding month.

Pemex production of natural gas from oil-directed wells, aka associated gas, rose by 5% year/year, while its non-associated gas production climbed 14.5%.

Private sector natural gas production totaled 208.1 MMcf/d, down from 231 MMcf/d in May 2020.

Mexico’s crude oil production, meanwhile, averaged 1.68 million b/d for the month, up from 1.64 million b/d a year ago, but down from 1.7 million b/d in April.

Pemex oil output totaled 1.62 million b/d, up from 1.59 million b/d in May 2020 but down slightly from 1.63 million b/d in April , CNH data showed.

Private sector oil production rose 15.7% y/y to average 65,238 b/d in May.

In a June investor presentation, Pemex said it plans to double capital expenditures (capex) to 225 billion pesos, or about $11.3 billion in 2021 versus 2020.

The Dos Bocas oil refinery under construction in Tabasco state will account for 20% of capex this year, Pemex said.

In 2022, capex is forecast to be 324 billion pesos ($16.3 billion), with Dos Bocas accounting for 36% of the total.

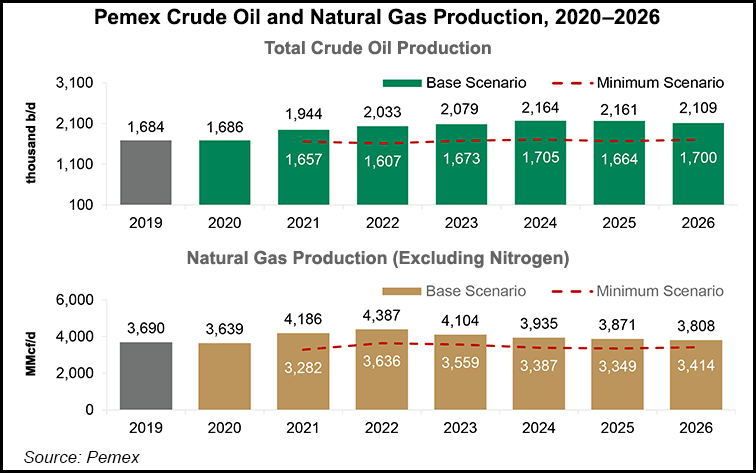

Pemex expects oil production to average about 1.9 million b/d in 2021 and 2 million b/d in 2022, and to plateau at 2.2 million b/b in 2024.

Exploration and production capex is expected to toal 289.9 billion pesos ($14.5 billion) in 2021, up from 180.5 billion pesos ($9.05 billion) realized in 2020.

Increased investment by Pemex “seems to have favorably influenced [Pemex] oil production, which has stabilized around 1.7 million b/d with the expectation that it will increase by an additional 100,000 b/d by the end of 2021,” wrote BBVA Research analysts arnulfo Rodríguez and Carlos Serrano in a note on Tuesday.

However, pandemic-induced oil demand and price destruction in 2020 worsened Pemex’s already precarious financial situation, the researchers said.

The company reported negative equity of 2.4 trillion pesos ($120.6 billion) and negative working capital of 466 billion pesos ($23.4 billion) as of March 31.

Rodríguez and Serrano said that tax breaks and capital injections by Mexico’s government have helped mitigate the adverse impacts of the pandemic, and “considerably reduced” Pemex’s net debt.

The researchers said it is “questionable” that Pemex will receive similar government support packages over the coming years as it did in 2020 and 2021.

“To improve its finances in a more permanent manner, [Pemex] will have to better control its operating costs and focus its investments in the most productive oilfields,” they said.

Rodríguez and Serrano also recommended that Pemex resume its farmout program to attract capital and knowhow from the private sector, “in particular in deep waters.”

Finally, they warned, “Pemex will have more difficulties obtaining financing on competitive terms due to the increasing number of global investors adopting environmental sustainability criteria in their investment decisions.”

Andrew Baker. (2021). Natural Gas, Oil Production Up in Mexico as Pemex Capex Set to Increase. USA. Natural Gas Intelligence. Recuperado de